Recommended

As the UN General Assembly meets in New York and as we get ready to head into the annual meetings of the IMF and World Bank in a few weeks, I thought it would be a good idea to give a brief recap on where we stand with Special Drawing Rights (SDRs). (If you want to know more about SDRs—from the basics to the nitty gritty details—see our work on this mini-website.)

Let’s start with the bottom line: No vulnerable country has received a single recycled SDR, yet—almost a year after the pledge of the G20 to recycle $100 billion.

And now the details, with links to even more details:

The allocation

-

$650 billion dollars’ worth of SDRs were issued by the IMF on August 23, 2021. Each country received an allocation proportional to its IMF quota.

-

Countries have used those SDRs in a variety of ways. The IMF has summarized what they have found from their conversations with country officials about the use of the new allocation, information which you can find here.

-

There has been a small movement of SDRs towards low- and middle-income countries, but the bulk still rests with the advanced countries. CGD just began publishing a monthly SDR report. The update on movements in July are considered here, and the report for August will be found here when it is published.

Recycling SDRs: Where the recycled SDRs will come from

-

In October 2021, the G20 pledged to recycle $100 billion worth of SDRs from members to vulnerable countries.

-

To date, pledges appear to amount to about $59.5 billion, not including $21 billion from the United States, which failed to get congressional approval but is in the legislative mix again. (The G20 does not publish its internal list of pledges—the ONE Campaign keeps track of pledges through press announcements.)

Recycling SDRs: The institutions and instruments to be use for recycling

-

Two channels for SDR recycling have been confirmed, both through the IMF: the Poverty Reduction and Growth Facility (PRGT) and the Resilience and Sustainability Trust (RST).

-

Across the two facilities, the IMF is aiming to absorb about SDR 50 billion (US$ 65 billion) of recycled SDRs, but only a small portion has been formally committed.

-

For the PRGT, since August 2021, donors have indicated their intention of recycling SDR 9.4 billion (about $12 billion). About half of these pledges have been committed through loan agreements between the donors and the IMF (see here). The IMF is seeking at least another SDR 3.2 billion (about US$4 billion) more in recycled SDRs for the PRGT.

-

For the RST, the IMF has announced pledges of SDR 29 billion of recycling. Spain was the first country to sign an agreement to provide funds to the RST, reportedly amounting to about $1.9 billion. A list of other possible donors has been given, but no specific amounts have been associated publicly with any donor.

-

-

The use of the remaining SDR21.1 billion is quite unclear as there are no other active recycling channels:

-

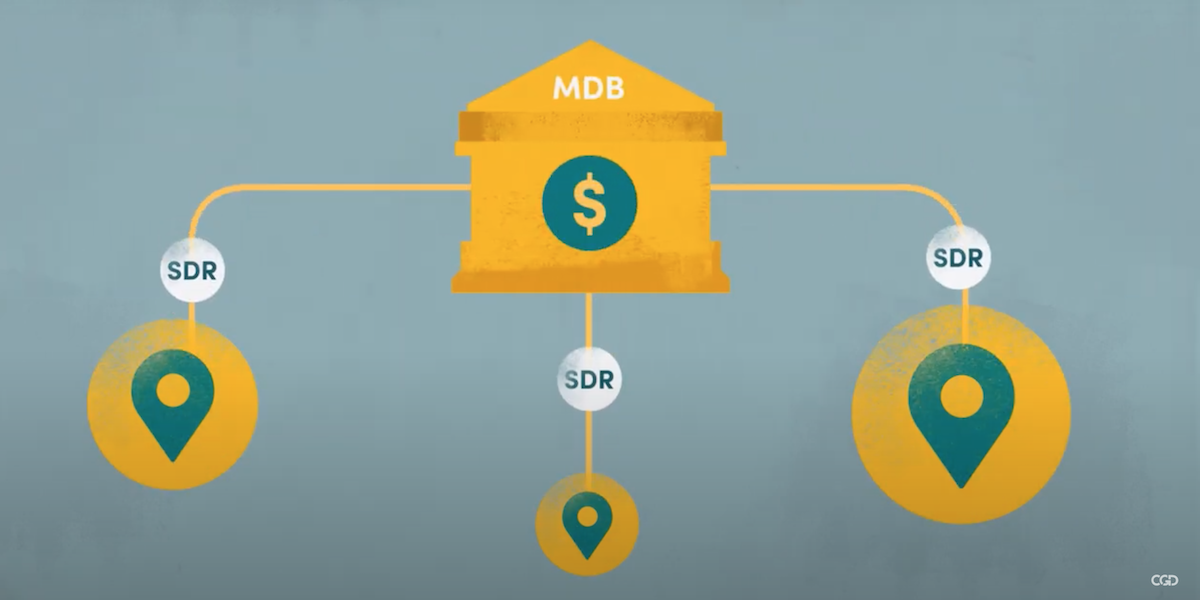

The African Development Bank is actively developing a proposal to use SDRs in a hybrid capital instrument to expand the Bank’s lending capacity.

-

Other multilateral institutions have expressed an interest in mobilizing recycled SDRs for lending or capital enhancement but none of these proposals are in an advanced stage.

-

Some G20 countries are said to be considering (or have actually effected) bilateral recycling—that is lending or granting SDRs to another country without an intermediary such as the RST. There is no transparency on these plans.

-

Recycling SDRs: How much has been received by LMICs?

-

None.

What are the hold ups?

-

For the PRGT: The IMF has yet to sign commitment agreements with 8 donors who have indicated pledges to the PRGT and continues its loan resource fundraising.

-

For the RST: The Trust has been approved but lending has not yet begun. Only one commitment agreement has been signed between the IMF and donors. The composition of the SDR 37 billion of pledges is unclear. Four countries have publicly announced a desire to borrow under the RST: Argentina, Barbados, Costa Rica, and Bangladesh. Once the Trust has been activated, disbursements would likely take place at the time of the next review of each countries existing program.

-

For recycling to MDBs: The G20 insists that any recycling plan must preserve the reserve asset characteristic of recycled SDRs, ensuring that they remain very low risk and encashable on call. Discussions continue among MDBs, the IMF, and the donors as to how this can be accomplished. Many donors are awaiting the outcome of these discussions to decide how to allocate the SDRs they have promised to recycle.

What else is being proposed?

-

Another allocation: Frustrated with the slow pace of recycling, there have been calls for another SDR allocation in 2022 or 2023. This would be permitted under IMF rules but would require approval by an 85 percent vote of IMF members. This might be a high hurdle given current geopolitical tensions, as no IMF member with a recognized government can be restricted from receiving its share of a new quota.

-

Others have argued for a more fundamental reform of the SDR to make it a more useful financial instrument.

This blog was updated on Sept. 29 to include Barbados on the list of countries that have announced a desire to borrow under the RST, and to reflect an increase in France’s SDR pledge.

This blog was updated on Oct. 13 to correct a unit, that the RST has announced pledges of US$37 billion (SDR 29 billion), not SDR 37 billion.

Disclaimer

CGD blog posts reflect the views of the authors, drawing on prior research and experience in their areas of expertise. CGD is a nonpartisan, independent organization and does not take institutional positions.