Abstract

The Russia–Ukraine conflict has triggered an energy crisis that directly affected household energy costs for heating, cooling and mobility and indirectly pushed up the costs of other goods and services throughout global supply chains. Here we bridge a global multi-regional input–output database with detailed household-expenditure data to model the direct and indirect impacts of increased energy prices on 201 expenditure groups in 116 countries. On the basis of a set of energy price scenarios, we show that total energy costs of households would increase by 62.6–112.9%, contributing to a 2.7–4.8% increase in household expenditures. The energy cost burdens across household groups vary due to differences in supply chain structure, consumption patterns and energy needs. Under the cost-of-living pressures, an additional 78 million–141 million people will potentially be pushed into extreme poverty. Targeted energy assistance can help vulnerable households during this crisis. We emphasize support for increased costs of necessities, especially for food.

Similar content being viewed by others

Main

Energy markets have tightened since the COVID-19 pandemic, and the situation was exacerbated considerably following the Russia–Ukraine conflict in late February 2022, contributing to a global energy crisis1. Global energy prices surge because of a variety of factors, including the ongoing geopolitical conflict, a rapid global post-pandemic economic recovery, continued high reliance on fossil fuels and the severe mismatch between energy demand and supply1,2. Russia is a major exporter of oil (12.3% of global supply in 2021) and natural gas (23.6%)3. European countries reliant on oil and natural gas imports from Russia, already at high risk since gas storages were nearly and probably deliberately emptied before the war4, face unprecedented fuel supply shortages only slightly tempered by slowing economic growth and a mild winter in 2022–2023. At the same time, emerging economies suffer from high fuel-import costs and fuel deprivation5,6. Missed opportunities to redirect investments after the COVID-19 crisis with huge amounts of money used to kick-start the economy7 and earlier slow progress in the energy transition8 are reflected in and have been amplifying the dependency on fossil fuel imports and the severity of the cost-of-living crisis. This crisis has pushed a number of economies into recession, caused higher inflation9, and put painful cost-of-living pressures on households around the world10,11.

High energy prices impose cost burdens on households in two ways. On the one hand, fuel price rises directly increase household fuel bills (for example, for heating and cooling, cooking and mobility). On the other hand, energy and fossil feedstock inputs needed for the production of goods and services for final household consumption will lead to higher prices of household-expenditure items12,13. Due to the unequal distribution of income, reflected in different household consumption patterns, surging energy prices could affect households in very different ways11,14,15. Unaffordable costs of energy and other necessities would push vulnerable populations into energy poverty and even extreme poverty16. Understanding how global energy prices are transmitted to households through global supply chains and how they are affected is crucial for effective and equitable policy design.

Numerous studies have analysed the potential impacts of the Russia–Ukraine conflict on the energy system8,17,18, global food supply19,20,21,22 and global economy9,23. In terms of household losses, research has focused on increased household energy costs14,15,24, energy insecurity17,25 and poverty16 caused by the crisis. However, quantitative research on the distribution of effects across households is limited, especially for developing countries. Many governments have introduced multiple fiscal measures to subsidize soaring energy bills for households24,26. These measures might be insufficient given the burden imposed by energy costs.

To fill these gaps, this paper provides a detailed assessment of the energy price shock on households and highlights the disparities of direct and indirect energy burden across different expenditure groups. We conduct a global comparative analysis of household burden across consumption levels under a set of price scenarios triggered by the Russia–Ukraine conflict. We design one base case and nine energy price scenarios (Supplementary Table 1) to examine the potential impacts of global price spikes on five fuels and fuel products (that is, coal, coal products, crude oil, petroleum products and natural gas). By linking a highly detailed expenditure database27 based on the World Bank’s Global Consumption Database (WBGCD)28 to a global multi-regional input–output database29, we model the direct and indirect burden of increased energy prices on households with different consumption patterns. We distinguish between 201 expenditure groups in 116 different countries, covering 87.4% of the global population, with a focus on developing countries. Given huge cost-of-living pressures, we quantify the additional population in energy poverty and extreme poverty under each price scenario. Our model captures short-term effects including ripple effects through global supply chains (Methods)30,31. It provides robust results at fine-sector resolution for a large number of countries and categories of households. Our results help to identify vulnerable households, thereby offering a basis for targeted support measures. Assumptions and limitations are given in Methods.

Surge in household burden for different scenarios

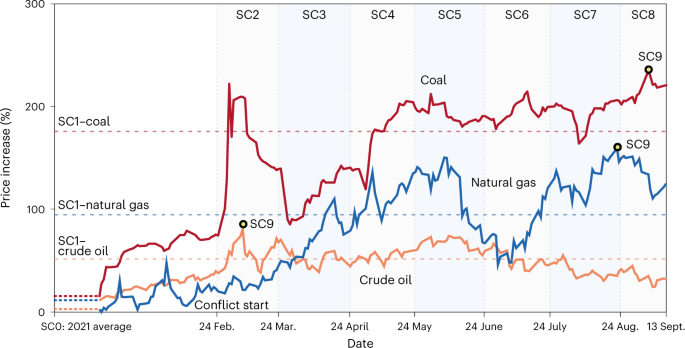

Since the conflict began, energy prices have increased sharply but with varying levels and volatilities for different fuels (as shown in Fig. 1). To measure the impacts triggered by this crisis, we collected recent global daily energy price data. We set the pre-crisis energy price scenario (SC0) to the average energy prices of 2021. For comparison, we set nine additional energy price scenarios (SC1–SC9) to reflect price changes for coal and coal products, crude oil and petroleum products and natural gas since 24 February 2022. SC1 refers to the average price scenario based on average prices from 24 February to 13 September 2022. SC2–SC8 model the possible effects under monthly average price increases. SC9 is an extreme scenario (based on peak prices for all fuels). Differences in levels and combinations of energy price increases help to reveal the potential magnitude of short-term impacts on households’ cost burden.

Prices for crude oil (Brent; orange), natural gas (US natural gas futures; blue) and coal (Newcastle; red) are shown. SC1 (horizontal dashed lines) refers to the average price for coal and coal products (+176%), crude oil and petroleum products (+51%) and natural gas (+94%) from 24 February to 13 September 2022. SC9 (black circles) refers to peak prices for coal and coal products (+235%), crude oil and petroleum products (+80%) and natural gas (+159%) during this period. SC2–SC8 (highlighted by vertical dotted lines) refer to monthly average prices. All references for price-scenario settings are provided in Supplementary Table 1.

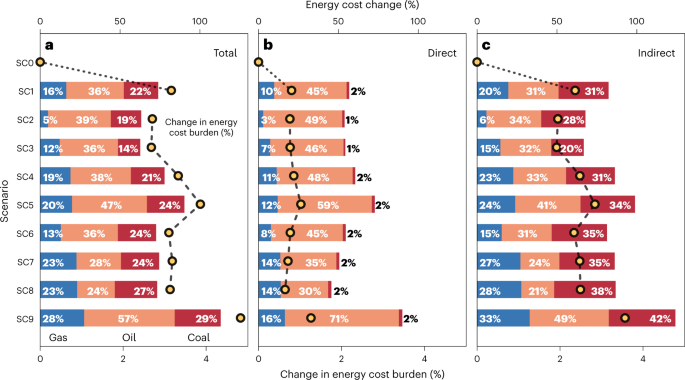

As shown in Fig. 2, we assessed the changes in household energy costs, including direct energy costs for fossil fuel bills and indirect energy costs that affect price changes in goods and services based on energy requirements and input of fossil feedstock to production throughout global supply chains. Rising energy prices have created additional burdens on households’ daily consumption. We calculated the change in energy cost burden rates, which refers to additional energy costs in household total expenditure compared with pre-crisis levels. We choose the share of total expenditures rather than income as the former is less volatile, effectively reflecting patterns in household income, consumption and asset accumulation32.

a–c, Bars refer to per capita household energy cost increases compared with the pre-crisis energy price (SC0) for total (a), direct (b) and indirect (c) costs. Stacked bars show the contribution of each fuel to energy cost increases with blue representing natural gas, orange representing oil and petroleum products and red representing coal and coal products. Yellow dots refer to the increases in per capita energy cost burden rate (that is, the additional energy cost as a percentage of total household expenditure).

Under different energy price scenarios, total per capita household energy costs increased by a range of 62.6% (SC3) to 112.9% (SC9) at the global level, contributing to a 2.7–4.8% increase in household expenditure. Direct energy costs contributed 15.0–29.6% of additional costs, while indirect costs contributed 44.8–83.4%. Households’ indirect energy costs increased considerably more than their direct energy costs. Taking SC1 as an example, indirect energy costs rose by 82.3% (2.4% of total expenditure), compared with a 56.8% (0.8% of total expenditure) increase in direct energy costs. Rising prices for crude oil and petroleum products contributed the majority of the increase in total household energy costs (23.6–56.6%), followed by coal and coal products (14.0–28.8%) and natural gas (4.9–27.5%). The difference in fuel products’ contribution becomes larger when only direct energy costs are considered (that is, 29.7–71.3% from crude oil and petroleum products, 2.9–16.5% from natural gas and 1.1–2.3% from coal and coal products).

Energy cost burden for households across countries

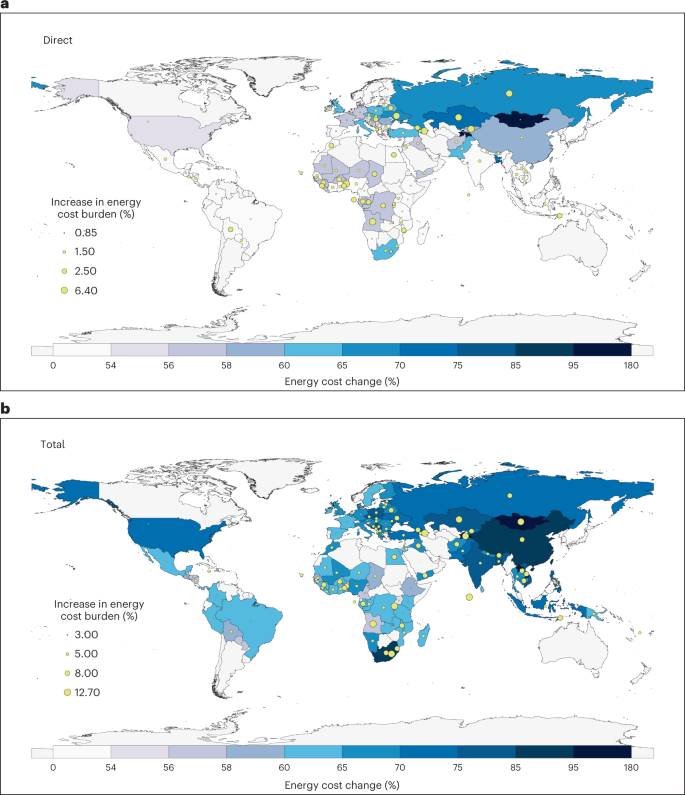

As shown in Fig. 3, direct and indirect impacts of household burden show considerably different distributions across countries. The distribution of total impacts is mainly determined by indirect impacts (Supplementary Fig. 1). Under SC1, the increases in direct energy costs of households in 116 countries range from 51.1% to 176.1%. Central Asian households saw the largest increases (70.3%), particularly in Mongolia (176.1%) and Tajikistan (176.1%). In comparison, Latin American households were the least directly affected (51.5%). When we consider the total (both direct and indirect) energy cost changes, households in Central Asia are still the most affected (80.7%), followed by South and Southeast Asia (74.5%). For example, direct energy costs for households in Laos ‘only’ increased by 51.1% (0.9% of total expenditure), but their total energy costs increased by 100.8% (5.2% of total expenditure). Total energy cost increases for households in Russia (71.6%) are slightly lower than the global average (73.9%).

SC1 refers to average prices for coal and coal products (+176%), crude oil and petroleum products (+51%) and natural gas (+94%) from 24 February to 13 September 2022. a, Direct impacts. b, Total (that is, direct and indirect) impacts. The colour of countries shows the per capita energy cost increase (grey countries are missing from the WBGCD and are not analysed). The size of the circle refers to the change in the per capita energy cost burden rate (that is, the additional energy cost as a percentage of total household expenditure). The results shown here do not involve actual devastation and disruption of production caused by the war and national measures to alleviate cost burdens such as national transfer payments and subsidies (more information is provided in the Limitations section in Methods). Base map layer: ‘World Countries’. Downloaded from http://tapiquen-sig.jimdo.com. Carlos Efraín Porto Tapiquén. Orogénesis Soluciones Geográficas. Porlamar, Venezuela 2015. Based on shapes from Environmental Systems Research Institute. Free distribution.

Higher energy costs imposed different levels of additional burdens on household consumption. Countries’ direct and indirect energy cost burden rates show different results. When considering only direct impacts, many sub-Saharan African and central Asian countries face huge increases in energy cost burden rates. Angola (6.4%), Azerbaijan (3.5%) and Benin (3.5%) are the top three countries. In terms of total burden rates, the largest increase occurred in Tajikistan (12.7%). Overall, the burden of household energy costs increased more in lower-income economies.

Notably, for some countries in sub-Saharan Africa, we found that the increases in household energy costs would be relatively small, but the burden rate would increase substantially. In the case of households in Rwanda, a low-income country in East Africa, its total energy cost increase (59.5%) would be 19.5% lower than the global average (73.9%). In comparison, Rwanda’s total energy cost burden rates would increase by 11.1%, three times higher than the global average (3.2%). One reason is that residential energy use in these countries is less dependent on fossil fuels (for example, 99.6% of households in Rwanda cooked with biomass in 2018 (ref. 33)), but the indirect energy costs through the supply chain have large negative impacts on these poor households.

To highlight the differences between economies at different income levels, we grouped country-level results into four groups based on the latest World Bank country classification by income34. In general, direct impacts for countries in each income group are more concentrated around the global average than their indirect results (Supplementary Fig. 2). It implies that household direct energy use is more uniform, but global supply chains vary widely across countries. For example, indirect impacts in middle-income economies have a larger variance than their direct impacts, compared with households in high- and low-income countries due to their consumption patterns and structure of supply chains. When considering total impacts, households in upper-middle-income countries show larger energy cost increases (a median of 68.1%). There are 19 countries where the average energy cost increases for households are higher than the world average, 16 of which are upper-middle- and lower-middle-income countries. Households in three high-income countries (Estonia (82.3%), Poland (78.0%) and the Czech Republic (75.5%)) suffer from above-global-average rises in energy costs, mainly due to their relatively high dependence on energy-intensive industries. In contrast, changes in energy costs for households in high-income and low-income countries are more clustered below the world average. The difference is that most high-income countries also have below-average rates of energy costs to total expenditure, which means more expenditure is spent on less energy-intensive products and services. In low-income countries, for poorer households already facing extreme energy poverty and severe food shortages, an increase in energy cost could lead to a greater risk of energy poverty14.

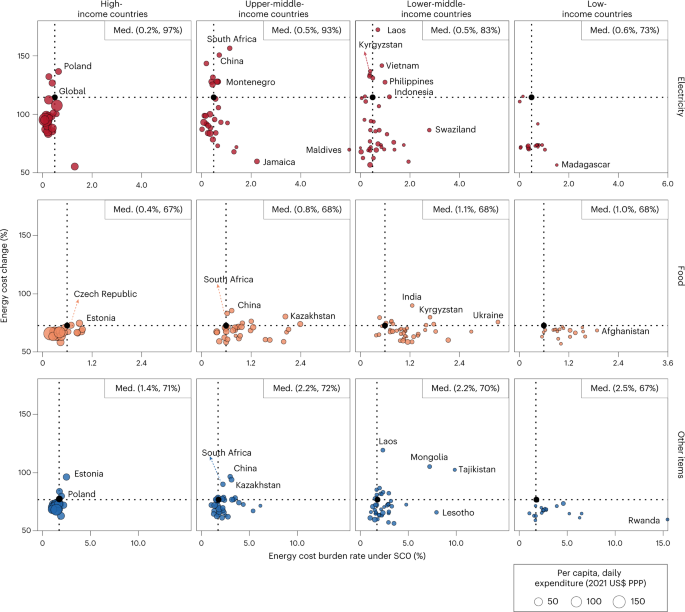

In addition, we decomposed the indirect impacts of rising energy prices on households into 33 expenditure items for 116 countries. Figure 4 shows the results for electricity, food and other items. Across different expenditure categories, changes in household energy burden are disproportionate to their pre-crisis energy cost burden rates (SC0). Compared with other items, households’ electricity costs tend to be most affected, but with large disparities between countries. For low-income countries, the cost increase in electricity (a median of 72.9%) is much lower than the global average (114.5%) because many households still lack access to electricity35. For upper-middle- (a median of 93.2%) and lower-middle-income (a median of 83.0%) countries, the impacts on electricity costs vary widely across countries. For example, electricity costs increased by 172.4% in Laos but only 56.7% in Haiti (a Latin American country). Energy cost changes in electricity in most high-income countries are below global levels because their electricity systems are less dependent on fossil fuels and thus less affected by rising fuel prices36. But there are noteworthy exceptions. For example, the electricity costs for Polish households are more affected than in other European countries because Poland is more dependent on coal for electricity generation (68.5% of coal power in 2020 (ref. 37)). When considering food consumption, the increase in energy costs is lower than that for electricity in most countries. Taking Kyrgyzstan (a country in central Asia) as an example, the increase in indirect energy costs for food (79.7%) in Kyrgyzstan is 40.5% lower than its rising electricity costs (133.9%). The energy cost-burden rate for food (1.7%) in Kyrgyzstan is 349.6% higher than for electricity (0.4%). In addition, for households in most low-income countries, the increase in indirect energy costs in food expenditure is slightly higher than for other products. It is noteworthy that under the pre-crisis scenario (SC0), Ukrainian households bore a huge cost burden from food consumption. Although the study does not consider war-induced supply chain disruptions, it can be inferred that soaring energy prices greatly exacerbated this burden.

The x axis represents the per capita energy cost burden rate (that is, the energy cost as a percentage of total household expenditure) under SC0 (that is, the pre-crisis energy price). The y axis represents the change in per capita energy cost between SC0 and SC1 (that is, average prices for coal and coal products (+176%), crude oil and petroleum products (+51%) and natural gas (+94%) from 24 February to 13 September 2022). The size of the bubble indicates the average per capita daily expenditure, expressed in 2021 purchasing power parity (PPP) for each country. The dotted lines represent the global average. The numbers in the upper right corner of each box are the median (Med.) for that group. The classification of countries by income is based on the World Bank34.

Distribution of energy cost burden across expenditure groups

We further explored the uneven effects across household groups by using detailed survey data from 116 countries. To highlight the differences between economies at different income levels, we aggregated the country-level results into four income groups.

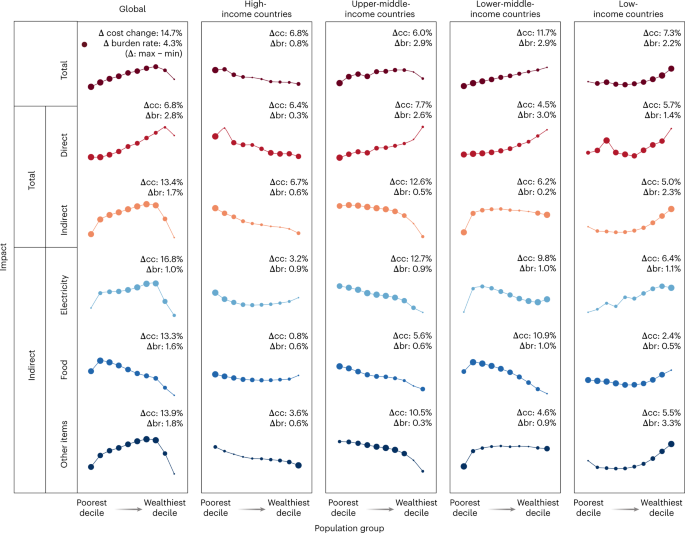

We examined the distribution of direct and indirect energy cost burden (both energy cost change and burden rate) for population deciles under SC1 (Fig. 5). We found substantial variations in household burden across population deciles. In general, the distribution of total burden in high- and low-income countries is largely dominated by their indirect burden, while that in middle-income countries depends to a larger extent on their direct results. For energy cost burden rates, the differences among population deciles are huge in upper- and lower-middle-income countries. Poorer households tend to bear higher total energy burden rates than richer households in most countries. Only for households in low-income countries, the total energy cost-burden rates show a progressive trend. When only the direct burden is considered, poorer households have lower increases in energy costs but suffer from higher burden rates, especially in middle-income countries.

SC1 refers to average prices for coal and coal products (+176%), crude oil and petroleum products (+51%) and natural gas (+94%) from 24 February to 13 September 2022. Points/curves show the per capita energy cost changes (in percent) per expenditure decile. The size of the circle refers to the energy cost burden rate (that is, the energy cost as a percentage of total household expenditure). The height of points on curves and the size of circles are comparable only within each subplot. The range (Δ, the maximum minus the minimum) among population deciles for each subplot is given in the upper right corner. Δcc equals the highest energy cost increases minus the lowest energy cost increases in each subplot. Δbr indicates the highest energy cost burden rates minus the lowest rates in each subplot.

The distribution of energy cost burden rates differs across household consumption categories. It is worth noting that the impacts on household food consumption are regressive across all country groups. Rising energy prices impose a huge burden on food consumption of the bottom 10% of the population. For example, the average energy cost burden rate in food of the bottom 10% of the population in Guinea (a West African country) is 65.7% higher than that of Guinea’s top 10%. For electricity, it is regressive within high- and upper-middle-income countries but progressive in low- and lower-middle-income countries.

We found the distributional effects differ notably between and within countries. Most of the high-income countries, such as the United States and Germany, show regressive effects, with poorer deciles facing higher rates of energy cost burden. Some countries, such as China, show greater cost increases in middle population deciles (trend shows inverted U shapes). Even countries with regressive or progressive distribution patterns, the burden of energy costs across population deciles can differ considerably. For example, Rwanda (a sub-Saharan African country) and Luxembourg (a high-income European country) show regressive effects. However, the total energy cost burden rate of the poorest decile in Rwanda is six times higher than the burden rate of the poorest decile in Luxembourg and ten times higher than that of the wealthiest decile in Luxembourg.

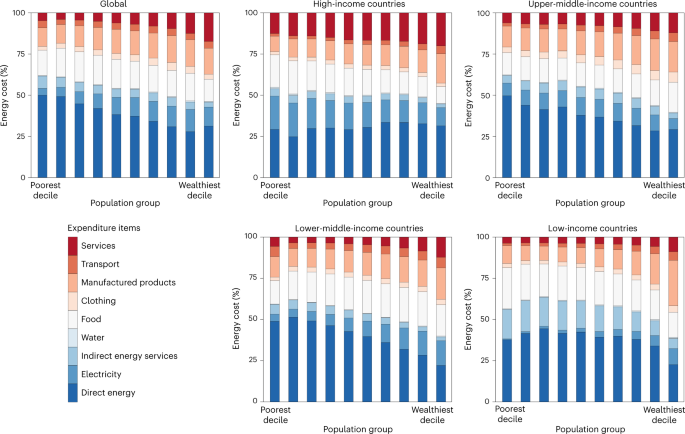

Differences in distribution between countries are determined by consumption structure and their supply chains. We investigated consumption patterns of groups via decomposing their energy cost-related expenditures, as shown in Fig. 6. Wealthier groups tend to have higher energy costs on goods and services with high value added, while poorer households tend to spend more on meeting daily needs such as food and direct energy. More vulnerable households tend to be more reliant on purchasing energy-intensive, processed goods and services. For each country group, direct energy and electricity use plays a dominant role, followed by food and clothing. For high-income countries, the proportion of direct energy costs is similar and relatively small across population deciles. Households bear declining direct energy cost burdens as their consumption levels increase in middle-income countries. For households in low-income countries, indirect energy services contribute notably to energy costs across all population deciles, especially poorer ones. Embodied energy costs in food consumption vary across populations and across different countries. For example, for the bottom 10% of the population in low-income countries, energy costs embodied in food consumption accounted for 24.9% of total energy costs, compared with 10.2% for the top 10% in high-income countries.

SC0 refers to the pre-crisis energy price. We aggregated 33 expenditure items represented in the WBGCD into nine sub-categories (Supplementary Table 2). Energy use for private transport is included in ‘Direct energy’. ‘Transport’ includes transportation services and motor equipment purchased by households.

Additional poverty caused by the energy crisis

Rising energy prices are making households more vulnerable to energy poverty, particularly during the cold season38. People in energy poverty do not have access to affordable energy services that support a decent standard of living, including adequate heating, cooling, lighting and energy to power appliances39. The International Energy Agency (IEA) recently reported that the number of people living without electricity is increasing worldwide. The IEA predicts that the population without access to electricity will rise by 2.7% in 2022 compared with 2021, with the rise occurring mostly in sub-Saharan Africa25. In this study, households are defined as being in energy poverty when their energy costs account for more than 10% of total expenditures40. We found that 166 million–538 million people (2.4–7.9% of the global population) in the 116 countries analysed are potentially moving into energy poverty due to global energy price spikes.

Referring to the World Bank’s latest international poverty line (US$2.15 in 2017 purchasing power parity (PPP) per person per day, updated in September 2022), we estimated that an additional 78 million–141 million people (1.2–2.1% of the global population) could be pushed into extreme poverty. Our results are 5–48% larger than the estimates from the World Bank (75 million–95 million compared with pre-crisis projections)16. There are three explanations for this variation. First, the two estimates are based on different scopes. We focus on the household-living burden due to direct energy price increases for fossil fuel products but also on indirect price increases induced by energy inputs to all final-use items. In contrast, the World Bank estimates look at the consequences of food and non-food inflation. According to the World Bank estimates, every 1% increase in food prices will bring nearly ten million more people to extreme poverty41. Second, the World Bank report assumed that all households within a country are equally impacted by the rising prices. However, according to our estimates, different households have been hit differently by the current crisis. Therefore, they underestimated the impacts of the ongoing crisis on global poverty. Third, our upper-bound estimates are based on an extreme scenario (SC9, based on peak prices for all fuels), which is higher than the World Bank’s potential price increases.

Discussion and conclusions

This study is motivated by the energy and cost-of-living crisis triggered by the Russia–Ukraine conflict. The relationship between resources and conflicts is complex42,43. Energy can be a cause of conflict, such as securing energy resources and competing for other resources44. Energy also can be a means of conflict. For example, involved countries limit energy supply to increase leverage over energy-dependent countries45. The 2022 energy crisis is one such example. In contrast to the oil shocks of the 1970s, the energy crisis under the Russia–Ukraine conflict involves soaring prices for all fossil fuels1. The global economy is much more interconnected than before, magnifying negative impacts through global supply chains, putting painful cost-of-living pressures on households12,13. In this context, this paper quantifies short-term living cost increases experienced by households worldwide due to global energy price hikes following the Russia–Ukraine conflict. This reflects economic actors’ limited ability to adopt new technologies and switch to other fuels in the short run. We detail how household burdens vary with international energy prices across and within 116 countries.

Distributional impacts on households show considerable variation across and within different countries, which are largely determined by household consumption patterns and the fossil fuel dependency of global supply chains. Comparing across countries, households in central Asian countries are most affected in terms of total energy cost, and sub-Saharan African countries are most affected in terms of total energy cost burden rate. Wealthier households tend to have heavier burden rates of energy costs in low-income countries, whereas poorer households tend to have higher rates in high-income countries. Wealthier groups tend to have higher energy costs on goods and services with high value added, while poorer households tend to spend more on meeting daily needs such as food and direct energy. Furthermore, we show how this crisis is exacerbating energy poverty and extreme poverty worldwide. For poor countries (for example, sub-Saharan African countries), living costs undermine their hard-won gains in energy access and poverty alleviation. Ensuring access to affordable energy and other necessities is even more urgent for those countries25.

At this juncture, protecting vulnerable households should be a clear priority. European governments have successively adopted several fiscal measures to shield households from soaring energy bills, such as energy tax reductions, energy retail price freezes, energy bill discounts or subsidies and energy price caps24,26. For example, most European governments including Romania, Estonia and Latvia have provided one-off energy subsidies for low-income groups26. Developing countries such as Thailand also took action, including extending the diesel tax cut and increasing subsidies for household electricity bills46. In addition to policies on direct energy consumption, some countries have increased assistance to vulnerable groups (for example, pensions, rent subsidies and child benefits) to ease the rise of the cost-of-living burden26. Our research emphasizes the necessity to alleviate increased costs of necessities caused by energy price hikes, especially for food and especially for low-income households. In response to the surge in food costs, governments can alleviate such household burden in many ways, such as setting price subsidies, implementing import taxes with clear sunset clauses for basic staple food, direct transfers for low-income households31 and investing in and providing incentives for and legislation to support food supply chains with sustainable sources of energy. In this crisis, energy companies reaped higher profits5. To recoup some of the additional strains on national budgets, governments are implementing and discussing windfall taxes for energy companies (for example, the United Kingdom, Italy and Cyprus)47.

It is worth noting that short-term policies addressing the cost-of-living crisis must be in line with climate-mitigation goals and other long-term sustainable development commitments. However, the energy transition is threatened by existing subsidies for fossil fuels17, fuel-tax cuts48 and increased investments in quickly available fossil resources10. High energy prices are reshaping global energy markets and pushed some European countries to delay the phase out of fossil fuels49 while seeking alternative sources abroad (for example, liquefied natural gas (LNG) from the Asia–Pacific region) and investing more in carbon-intensive infrastructure (for example, floating storage and regasification units in Southeast Asia)50. The fuel scramble led by the advanced economies creates potential spillover effects on others5,49. For example, if Europe dominates the global LNG supply and LNG terminal (for example, floating storage and regasification units), some traditional consumers, especially in the Asia–Pacific region, could revert to quickly available fossil-intensive resources10. Moreover, increased energy costs might squeeze poor countries’ investment in renewable energy infrastructure due to limited budgets5. Overall, these emergency measures could temporarily solve the current dilemma but create carbon lock-in, slow down the energy transition and further delay already short-falling climate-mitigation efforts globally2,50. In addition, and frequently overlooked, is the fact that renewables have their own set of problems such as a potential increase in prices for scarce materials required to produce technologies based on renewables, with similar or even higher dependencies and market concentrations51.

This unprecedented global energy crisis should come as a reminder that an energy system highly reliant on fossil fuels perpetuates energy-security risks and accelerates climate change8,52. In particular, existing high energy prices and recent Organization of Petroleum Exporting Countries limits on oil exports have further pushed prices higher53. These emphasize the urgency to realize diversified energy sources and develop a more secure, diverse, reliable and independent energy system by accelerating the clean energy transition for all countries. The European Commission proposed the REPowerEU Plan to spur massive investment in renewable energy, scale up electrification and seek substitute fuels in industry, building and transport sectors52. The EU solar energy strategy plans to increase the installed capacity of solar photovoltaics to 320 GW by 2025, more than doubling current levels52. For poor countries, the 27th United Nations Climate Change Conference of the Parties emphasizes international cooperation to provide tailor-made financial and technical assistance (for example, affordable loans to local public authorities) to wean them off coal and build renewable energy markets. We call for more attention to countries that have been severely affected by this crisis. Multilateral action is critical to address potential energy transition bottlenecks and alleviate inequalities in access to affordable energy for households worldwide35.

Methods

Overview

In this study, we used an environmentally extended multi-regional input–output (EEMRIO) approach to estimate both direct and indirect household energy costs. This model is able to reflect the short-term energy price transmission throughout global supply chains. In the short run, companies and households have only limited options to adjust their consumption patterns and underlying technological choices (for example, switch from a gas burner to solar photovoltaics) as they are locked into their past technology choices and thus their current energy use. Compared with other models, it has the advantage to estimate the direct and indirect impact of energy prices on households. To measure the magnitude of the impact of energy price fluctuations, we designed one base case, that is, the pre-crisis energy price scenario (SC0) and nine energy price scenarios (SC1–SC9) to capture the potential distributional impacts of different energy price scenarios. Additional poverty was assessed under each energy price scenario. Data sources and processing are provided. Assumptions and uncertainties for all calculations are also given. Datasets for different expenditure groups in 116 countries are available in Supplementary Dataset 1.

Household energy costs

The total household energy costs of the expenditure group g for fuel k in region r (ecg,k,r) can be calculated as the sum of direct energy costs ecdirect,g,k,r and indirect energy costs ecindirect,g,k,r:

Direct energy costs for households

The direct energy costs can be calculated using the household direct energy consumption enhhs,g,k,r multiplied by the energy price of fuel k (pk):

Indirect energy costs for households

The EEMRIO framework was applied to estimate the indirect energy costs (ecindirect,g,k,r). Indirect energy costs refer to expenditure of goods and services due to fossil fuel uses throughout global supply chains. Taking plastic consumption as an example, oil is not only used as a direct feedstock for producing plastic, but oil and other forms of energy are used during the entire global supply chain from extraction to transport, transformation in factories and so on, all the way to the final product and to the final consumer. The production processes involved in consumption-based accounting (indirect results) are highly complex but traceable through the EEMRIO approach.

EEMRIO analysis has been widely used in numerous energy, environmental and economic studies to reveal impacts through entire global supply chains54,55,56. We selected the EEMRIO approach due to its unique ability to provide robust results at fine-sector resolution for a large number of countries and categories of households (for similar studies see, for example, refs. 31,57,58). Our model is able to estimate short-term effects of energy price hikes on households before changes in industrial production processes and the adoption of adaptive measures by consumers (for example, changing lifestyles and consumption behaviours59). Such short-term estimates could be good references for socially acceptable public policies for rising energy prices31,60. Numerous studies have examined the distributional effects of environmental and economic elements (for example, energy footprints61, carbon footprints27,57,62 and carbon pricing30,31) on households across countries and regions using the EEMRIO framework with MRIO tables at its core54,56,63.

The MRIO approach is able to characterize the monetary flows among sectors and consumers of different regions. For each row of an MRIO table, a linear equation can be used to depict the production of the economy:

where \(x_i\!^r\) is the total output of sector i in region r; \(z_{ij}\!^{rs}\) denotes the intermediate inputs from sector i in region r to sector j in region s; \(y_i\!^{rs}\) is the final demand (that is, household consumption, government consumption and investment) of region s from sector i in region r. On the basis of the Leontief framework64, the basic linear equation can be expressed in matrix form as:

where \({{{\mathbf{X}}}} = \left( {x_i\!^r} \right)\) is the total output vector; L = (I − A)−1 is the Leontief inverse matrix or total requirements matrix, with the element \(l_{ij}\!^{rs}\) showing the total inputs of sector i in region r required to satisfy one unit of final demand in sector j in region s; \({{A}} = \left( {a_{ij}^{rs}} \right) = \left( {z_{ij}^{rs}/x_j^s} \right)\) refers to the technological coefficient matrix in which \(z_{ij}\!^{rs}\) represents the intersectoral economic linkages between the regions, and I is an identity matrix with the same size of A; \({{{\mathbf{Y}}}} = \left( {y_i\!^{rs}} \right)\) is the final demand vector. As we focus on the burden of the global energy price crisis on households, thus, the energy costs by government consumption and investments are not included in the analysis. Therefore, the final demand vector Y covers only household consumption.

We created a row vector \({{{{\varepsilon }}}} = \left( {\varepsilon _i^r} \right)\) to represent the energy cost coefficient (that is, energy costs per unit of total output), with the element \(\varepsilon _i\!^r\) representing the energy cost coefficient of sector i in region r:

where \(\mathrm{ec}_i\!^{\mathrm{industry},g,k,r}\) is the industrial energy costs of the expenditure group g for fuel k of sector i in region r, which can be calculated as follows:

where \(\mathrm{en}_i\!^{\mathrm{industry},g,k,r}\) is the industrial energy consumption, and pk is the price of fuel k as defined in equation (2).

Thus, the indirect energy cost ecindirect matrix can be calculated by pre-multiplying X with an energy cost coefficient as follows:

where the element \(\mathrm{ec}_i\!^{\mathrm{indirect},g,k,r}\) in ecindirect refers to the indirect energy costs induced by the household final demand of group g for fuel k in sector i in region r.

Burden of rising energy costs on households

Given an increase in energy prices, we can calculate direct and indirect energy cost changes, separately. We introduced three indicators to evaluate the household burden due to energy price hikes.

One is energy cost change, which includes direct energy cost changes for fossil fuel bills and indirect energy costs affecting price changes of goods and services based on the energy requirements throughout global supply chains. It is worth mentioning that the change in indirect energy costs does not refer to the increase in the actual purchasing price for products but the increase in energy costs reflected in products. In this case, the change in indirect energy costs can be much higher than direct cost changes. The second indicator is the energy cost-burden rate, which refers to the share of direct and indirect energy costs in total household expenditures. The last is the change in the energy cost burden rates, which measures the increase in the energy burden rate compared with the pre-crisis level (SC0).

Additional poverty caused by the energy crisis

The global energy crisis is exacerbating the plight of the world’s poor41. Given the combined crises of COVID-19, growing inflationary pressures and the war in Ukraine, many reports and news have mentioned the impacts on global poverty14. However, quantitative research on the potential consequences of rising energy prices on global poverty is still lacking but much needed. To fill these gaps, we assessed the households’ additional expenditures due to increased direct and indirect energy costs. We considered the differential impacts on households with various consumption patterns. Assuming that the total expenditure of households remained the same in the short term as before the price increase, the additional energy costs will lead to a reduction in the purchasing power for other essential needs. As a result, some people living above US$2.15 a day in 2017 PPP (that is, the international poverty line, a global absolute minimum, updated in September 2022) would be pushed to extreme poverty due to their inability to meet basic living needs. In this context, we assessed the additional population in extreme poverty under each energy price scenario. According to a recent World Bank report65, the global poverty rate (at the extreme poverty line) in 2021 is 8.9%. On the basis of this poverty rate and our matched expenditure and population data for 201 expenditure groups, we derived a relative poverty line for the year 2021. For each expenditure group, we subtracted their additional energy costs from the corresponding total household expenditures. The rest was compared with the relative poverty line to determine whether the group has been pushed into extreme poverty. Our approach makes it possible to obtain an additional number of people in poverty due to costs of living pressures under each price scenario.

In addition, rising energy prices are also putting more people at risk of energy poverty. Energy poverty is a multi-dimensional issue and can be measured by various definitions and indicators39. On the basis of our estimated rises in energy costs during this crisis, we selected the maximum percentage of household energy costs in consumer income or expenditure as a measure of energy poverty. We use 10% of households’ total expenditure spent on energy bills (for residential fuels and electricity use) as our energy poverty set point40. For each expenditure group, the additional number of people considered to be energy poor due to increased energy bills was estimated under each price scenario.

Data sources and processing

To model the different impacts of rising energy prices on households, we applied the following data sources and preparation steps:

Energy price data

Energy price data are based on daily price data from 1 January 2021 to 13 September 2022 for five fossil fuels and fuel products: coal, coal products, crude oil, petroleum products and natural gas. We used Newcastle coal futures, Brent futures and US natural gas futures as benchmarks for coal and coal product prices, oil and petroleum product prices and natural gas prices, respectively. All price data were collected from the Trading Economics website (https://tradingeconomics.com/commodities).

Energy-consumption data and processing

Energy-consumption data are derived from IEA World Energy Balances36 for the year 2019. On the basis of a mapping approach provided by the Global Trade Analysis Project (GTAP) energy date set66, we processed the final energy consumption for the year 2019, consistent with the GTAP regional and sectoral classification. Final energy-use data cover energy used for combustion and non-energy used as feedstock. Household direct energy use is considered a separate vector, including private vehicle fuel use for mobility and residential energy use for heating, cooling and cooking. We extrapolated the energy-consumption data to the year 2021 based on the average annual gross domestic product (GDP) growth rate (from 2019 to 2021) for our research topic.

MRIO data and processing

The multi-regional input–output table is taken from the GTAP 11 Data Bases29, which contains high-resolution information on the interregional and intersectoral transactions of the world economy for the year 2017 in the purchaser’s price for 141 countries and regions. Each country or region has 65 economic sectors. Using consumer price indices from the World Bank67, the GTAP MRIO table of 2017 was inflated to the prices of 2021 to match our research topic.

Household-expenditure data and processing

Household-expenditure data are taken from the World Bank’s Global Consumption Database (WBGCD)28. The WBGCD provides consumer expenditure survey data for the year 2011 for 116 countries, representing 87.4% of the global population, especially with representation from developing countries28. For each country, the expenditure share and corresponding population share for 201 expenditure groups among 33 expenditure items are listed (Supplementary Table 2). Expenditure groups represent consumption levels ranging from US$0 to US$1 million per capita per year, expressed in 2011 PPP. For example, Group 0th (that is, the lowest consumption level) represents people consuming less than US$50 in 2011 PPP per year and Group 200th (that is, the highest consumption level) is for the group consuming between US$0.95 million and US$1 million in 2011 PPP per capita per year. Not all countries will have populations in all groups. For consistency reasons, we used the detailed expenditure structure (instead of real consumption data) for the year 2011 from the WBGCD to disaggregate the total household final demand in the GTAP MRIO table. Given the lack of more recent consistent data, we assumed that the expenditure structure of each expenditure group in each country remains the same as they were in 2011.

Bridging and matching WBGCD to GTAP 11

The expenditure data from the WBGCD come with different regional and sectoral classifications than the GTAP, so it is necessary to transform them into a GTAP format. Following the approaches of previous studies27,61,62, we bridged and matched the WBGCD with GTAP 11 household final demand vectors in three steps.

First, we matched the country and region classification between the two datasets. First, we downscaled household final demand of aggregated regions in the GTAP to the national level. We assumed that households in countries within one aggregated region have similar consumption patterns. Therefore, these aggregated final demand vectors can be divided into country levels based on their population share in the overall population of the corresponding aggregated region. We used the latest population data for 2020 from the World Bank67. Second, we calculated the final demand for each expenditure group in each country by multiplying the expenditure share of groups from the WBGCD with the household final demand from the GTAP MRIO. Third, using a bridging matrix, we linked the 33 expenditure items in the WBGCD to the 65 economic sectors in the GTAP MRIO. The bridging matrix reflects the corresponding relationships of sectors between the two datasets. We ended up with a matrix of 9,165 rows by 23,316 columns, containing household final demand for 201 expenditure groups from 116 WBGCD countries from 65 economic sectors in 141 GTAP countries and regions. Due to data availability, especially of the household-expenditure dataset, which is the main focus of our study, we cover 116 countries representing 87.4% of the global population and 80.3% of global GDP (more details in the Limitations section). We list the 116 countries analysed in this study in Supplementary Table 3.

Price scenarios

To quantify possible effects on global household burdens, this study developed one base case and nine scenarios drawn from daily energy prices. All references for price-scenario settings are provided in Supplementary Table 1.

In short, we chose the average energy prices of 2021 as the base case, called the pre-crisis energy price scenario (SC0). We developed an average price scenario (SC1) to capture the distributional impacts of the global energy crisis on household living burdens. SC1 refers to the price for coal and coal products (+176%), crude oil and petroleum products (+51%) and natural gas (+94%) from 24 February to 13 September 2022. As a sensitivity analysis, we also modelled the possible effects of price increases under the monthly average price scenario (SC2–SC8). An extreme scenario (SC9) was set, referring to peak prices for coal and coal products (+235%), crude oil and petroleum products (+80%) and natural gas (+159%) from 24 February to 13 September 2022. This study makes no statements about the likelihood of SC9 occurring.

Limitations

In modelling the energy costs for households, consistent with existing research30,31, we assumed that energy price changes in production sectors are fully passed on to final consumers. In other words, households bear both the direct and indirect effects of rising energy prices. Expenditure levels were used to group households, without specifically considering other indicators that affect household consumption, such as household size, housing area and temperature27. We assumed that under price shocks, households maintain their previous consumption patterns in the short term. We focused on short-term consequences without considering demand elasticities and substitution possibilities. The short-term model assumes fixed coefficients of production and consumption and thus its micro-foundation is based on Leontief production function64, which is a commonly perceived limitation of input–output studies60,68,69 but a reasonable assumption in the short run where economic actors cannot easily switch to new technologies or fuels. In this context, the ability to adapt to and recover from energy disruptions, such as changing consumption patterns, fuels or energy technologies, all factors contributing to energy resilience, was not addressed in our research, given the relative short-term focus and assumption of technology lock-in. In addition, the aggregation of economic sectors in the MRIO table leads to uncertainties in indirect energy cost estimates. There are 65 sectors in the GTAP 11 Data Bases with all products and services allocated. Such relatively high aggregation makes it difficult to distinguish the economic activities of various products and services within sectors. Another major uncertainty comes from the collected data and the balancing procedures for the MRIO table.

In terms of data and data processing, this study is limited by the availability of relevant datasets. The consumer expenditure survey dataset from the WBGCD is for the year 2011. Consumption patterns and population share for each expenditure group were assumed to be the same as in 2011. Another limitation is that the GTAP 11 Data Bases and the WBGCD do not cover the data for all countries in the world. Some energy-consuming giants, such as Canada and Australia, are not covered in this study due to data availability. However, 141 countries and regions in GTAP 11 Data Bases account for 99.1% of the global GDP and 96.4% of the global population29. Data on 116 countries in the WBGCD cover 87.4% of the global population in 2020, especially with representation from developing countries. These datasets are the most detailed available datasets to date. Final energy-use data leads to another limitation. We assumed the same volume and structure of global energy demand in 2022 as in 2021, ignoring the impacts of energy supply-related issues behind the Russia–Ukraine conflict (for example, the import embargo of fossil fuels from Russia).

In price-scenario settings, we focused on the international price volatility of fossil fuels caused by this crisis without differences in purchase-price increases across countries. Global energy prices fluctuate on a daily basis, and we selected nine representative price scenarios.

We did not investigate the economic impacts of the disruptions and destruction within Russia and Ukraine caused by the war as without current data and a clear overview of the level of disruptions, these cannot yet be assessed.

Data availability

Global MRIO tables were obtained from the GTAP 11 Data Bases29. Energy-consumption data were retrieved from IEA36. The global expenditure data can be collected from the World Bank28. Energy price data were collected from the Trading Economics website (https://tradingeconomics.com/commodities). All other socioeconomic data (for example, population, GDP and inflation) used in this study were obtained from the World Bank67. All data generated and analysed in this study are available within the article and Supplementary Dataset 1. More detailed results are available from the corresponding author on reasonable request.

Code availability

Code developed for data processing in MATLAB is available in Supplementary Code 1.

References

Global Energy Crisis (IEA, 2022); https://www.iea.org/topics/global-energy-crisis

World Energy Outlook 2022 (IEA, 2022); https://www.iea.org/reports/world-energy-outlook-2022

Dale, S. BP Statistical Review of World Energy 2021 (BP, 2022); https://www.bp.com/content/dam/bp/business-sites/en/global/corporate/pdfs/energy-economics/statistical-review/bp-stats-review-2022-full-report.pdf

Milov, V. European gas price crisis: is Gazprom responsible? Eur. View 21, 66–73 (2022).

Global Impact of War in Ukraine: Energy Crisis (United Nations, 2022); https://unctad.org/webflyer/global-impact-war-ukraine-energy-crisis

Huang, M., Shao, W. & Wang, J. Correlations between the crude oil market and capital markets under the Russia–Ukraine conflict: a perspective of crude oil importing and exporting countries. Resour. Policy https://doi.org/10.1016/j.resourpol.2022.103233 (2023).

Shan, Y. et al. Impacts of COVID-19 and fiscal stimuli on global emissions and the Paris Agreement. Nat. Clim. Change 11, 200–206 (2020).

Żuk, P. & Żuk, P. National energy security or acceleration of transition? Energy policy after the war in Ukraine. Joule 6, 709–712 (2022).

Ozili, P. Global economic consequence of Russian invasion of Ukraine. Preprint at SSRN https://doi.org/10.2139/ssrn.4064770 (2022).

Tollefson, J. What the war in Ukraine means for energy, climate and food. Nature 604, 232–233 (2022).

Battistini, N., Di Nino, V., Dossche, M. & Kolndrekaj, A. Energy prices and private consumption: what are the channels? Econ. Bull. Art. https://www.ecb.europa.eu/pub/economic-bulletin/articles/2022/html/ecb.ebart202203_01~f7466627b4.en.html (2022).

Esmaeili, A. & Shokoohi, Z. Assessing the effect of oil price on world food prices: application of principal component analysis. Energy Policy 39, 1022–1025 (2011).

Gardebroek, C. & Hernandez, M. A. Do energy prices stimulate food price volatility? Examining volatility transmission between US oil, ethanol and corn markets. Energy Econ. 40, 119–129 (2013).

Mahler, D. G., Wu, H., Diaz-Bonilla, C., Ibarra, G. L. & Nguyen, M. C. High energy prices—who is most impacted and why? World Bank Blogs https://blogs.worldbank.org/opendata/high-energy-prices-who-most-impacted-and-why?CID=WBW_AL_BlogNotification_EN_EXT (2023).

Kalkuhl, M. et al. Effects of the Energy Price Crisis on Households in Germany (MCC, 2022).

Mahler, D. G. et al. Pandemic, prices, and poverty. World Bank Blogs https://blogs.worldbank.org/opendata/pandemic-prices-and-poverty (2022).

Zakeri, B. et al. Pandemic, war, and global energy transitions. Energies 15, 6114 (2022).

Zhou, X. et al. Influence of Russia–Ukraine war on the global energy and food security. Resour. Conserv. Recycl. https://doi.org/10.1016/j.resconrec.2022.106657 (2023).

Alexander, P. et al. High energy and fertilizer prices are more damaging than food export curtailment from Ukraine and Russia for food prices, health and the environment. Nat. Food 4, 84–95 (2023).

Bentley, A. Broken bread—avert global wheat crisis caused by invasion of Ukraine. Nature 603, 551–551 (2022).

Creutzig, F. Fuel crisis: slash demand in three sectors to protect economies and climate. Nature 606, 460–462 (2022).

Sun, Z., Scherer, L., Zhang, Q. & Behrens, P. Adoption of plant-based diets across Europe can improve food resilience against the Russia–Ukraine conflict. Nat. Food 3, 905–910 (2022).

Jakob, F. A., Friderike, K., Eliza, M. L. & Tobias, S. Economic, financial and monetary developments. Econ. Bull. 4, 1–149 (2022).

Ari, A. et al. Surging Energy Prices in Europe in the Aftermath of the War: How to Support the Vulnerable and Speed Up the Transition Away from Fossil Fuels (International Monetary Fund, 2022); https://www.imf.org/en/Publications/WP/Issues/2022/07/28/Surging-Energy-Prices-in-Europe-in-the-Aftermath-of-the-War-How-to-Support-the-Vulnerable-521457

For the First Time in Decades, the Number of People Without Access to Electricity is Set to Increase in 2022 (IEA, 2022); https://www.iea.org/commentaries/for-the-first-time-in-decades-the-number-of-people-without-access-to-electricity-is-set-to-increase-in-2022

Sgaravatti, G., Tagliapietra, S. & Zachmann, G. National Policies to Shield Consumers from Rising Energy Prices (Bruegel, 2022); https://www.bruegel.org/dataset/national-policies-shield-consumers-rising-energy-prices

Bruckner, B., Hubacek, K., Shan, Y., Zhong, H. & Feng, K. Impacts of poverty alleviation on national and global carbon emissions. Nat. Sustain. 5, 311–320 (2022).

Global Consumption Database (World Bank, 2022); https://datatopics.worldbank.org/consumption/

Aguiar, A., Chepeliev, M., Corong, E. & van der Mensbrugghe, D. The Global Trade Analysis Project (GTAP) Data Base: version 11. J. Global Econ. Anal. 7 (2022).

Steckel, J. C. et al. Distributional impacts of carbon pricing in developing Asia. Nat. Sustain. 4, 1005–1014 (2021).

Vogt-Schilb, A. et al. Cash transfers for pro-poor carbon taxes in Latin America and the Caribbean. Nat. Sustain. 2, 941–948 (2019).

Wier, M., Birr-Pedersen, K., Jacobsen, H. K. & Klok, J. Are CO2 taxes regressive? Evidence from the Danish experience. Ecol. Econ. 52, 239–251 (2005).

Koo, B. B. et al. Rwanda—Beyond Connections: Energy Access Diagnostic Report Based on the Multi-Tier Framework (World Bank, 2018); https://openknowledge.worldbank.org/handle/10986/30101

World Bank Country and Lending Groups (World Bank, 2021); https://datahelpdesk.worldbank.org/knowledgebase/articles/906519-world-bank-country-and-lending-groups

Theme Report on Energy Access (United Nations, 2021); https://www.un.org/ohrlls/content/theme-report-energy-access

World Energy Balances (IEA, 2022); https://www.iea.org/data-and-statistics/data-product/world-energy-balances

Poland 2022 (IEA, 2022); https://www.iea.org/reports/poland-2022

Belaïd, F. Implications of poorly designed climate policy on energy poverty: global reflections on the current surge in energy prices. Energy Res. Soc. Sci. 92, 102790 (2022).

González-Eguino, M. Energy poverty: an overview. Renew. Sustain. Energy Rev. 47, 377–385 (2015).

Boardman, B. Fuel Poverty: From Cold Homes to Affordable Warmth (Belhaven Press, 1991).

Poverty and Shared Prosperity 2022: Correcting Course (World Bank, 2022); https://openknowledge.worldbank.org/handle/10986/37739

Månsson, A. Energy, conflict and war: towards a conceptual framework. Energy Res. Soc. Sci. 4, 106–116 (2014).

Kerber, S. W., Gilbert, A. Q., Deinert, M. R. & Bazilian, M. D. Understanding the nexus of energy, environment and conflict: an overview. Renew. Sustain. Energy Rev. https://doi.org/10.1016/j.rser.2021.111473 (2021).

Sutrisno, A., Nomaler, Ӧ. & Alkemade, F. Has the global expansion of energy markets truly improved energy security? Energy Policy https://doi.org/10.1016/j.enpol.2020.111931 (2021).

Larrabee, F. S. Russia, Ukraine, and central Europe: the return of geopolitics. J. Int. Aff. 63, 33–52 (2010).

Arunmas, P. Energy subsidies extended. Bangkok Post (14 September 2022); https://www.bangkokpost.com/business/2390916/energy-subsidies-extended

Baunsgaard, T. & Vernon, N. Taxing Windfall Profits in the Energy Sector (International Monetary Fund, 2022); https://www.imf.org/en/Publications/IMF-Notes/Issues/2022/08/30/Taxing-Windfall-Profits-in-the-Energy-Sector-522617

Gars, J., Spiro, D. & Wachtmeister, H. The effect of European fuel-tax cuts on the oil income of Russia. Nat. Energy 7, 989–997 (2022).

World Energy Investment 2022 (IEA, 2022); https://www.iea.org/reports/world-energy-investment-2022

Gas Market Report, Q4–2022 (IEA, 2022); https://www.iea.org/reports/gas-market-report-q4-2022

The bottlenecks which could constrain emission cuts. The Economist (12 June 2021); https://www.economist.com/briefing/2021/06/12/the-bottlenecks-which-could-constrain-emission-cuts

Communication from the Commission to the European Parliament, the European Council, the Council, the European Economic and Social Committee and the Committee of the Regions (REPowerEU Plan, 2022); https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=COM%3A2022%3A230%3AFIN&qid=1653033742483

Oil Market Report–October 2022 (IEA, 2022); https://www.iea.org/reports/oil-market-report-october-2022

Feng, K., Hubacek, K. & Yu, Y. Local Consumption and Global Environmental Impacts: Accounting, Trade-offs and Sustainability (Routledge, 2019).

Wiedmann, T., Wilting, H. C., Lenzen, M., Lutter, S. & Palm, V. Quo vadis MRIO? Methodological, data and institutional requirements for multi-region input–output analysis. Ecol. Econ. 70, 1937–1945 (2011).

Minx, J. C. et al. Input–output analysis and carbon footprinting: an overview of applications. Econ. Syst. Res. 21, 187–216 (2009).

Hubacek, K., Baiocchi, G., Feng, K. & Patwardhan, A. Poverty eradication in a carbon constrained world. Nat. Commun. 8, 912 (2017).

Hubacek, K. et al. Global carbon inequality. Energy Ecol. Environ. 2, 361–369 (2017).

Creutzig, F. et al. Towards demand-side solutions for mitigating climate change. Nat. Clim. Change 8, 260–263 (2018).

Coady, M. D., Flamini, V. & Sears, L. The Unequal Benefits of Fuel Subsidies Revisited: Evidence for Developing Countries (International Monetary Fund, 2015).

Oswald, Y., Owen, A. & Steinberger, J. K. Large inequality in international and intranational energy footprints between income groups and across consumption categories. Nat. Energy 5, 231–239 (2020).

Zheng, H. et al. Ageing society in developed countries challenges carbon mitigation. Nat. Clim. Change 12, 241–248 (2022).

Wiedmann, T. & Lenzen, M. Environmental and social footprints of international trade. Nat. Geosci. 11, 314–321 (2018).

Miller, R. E. & Blair, P. D. Input–Output Analysis: Foundations and Extensions 2nd edn (Cambridge Univ. Press, 2009).

Poverty and Shared Prosperity 2020: Reversals of Fortune (World Bank, 2020); https://openknowledge.worldbank.org/handle/10986/34496

McDougall, R. & Chepeliev, M. GTAP 10 Data Base Documentation Ch. 11 (Center for Global Trade Analysis, 2019).

World Bank Open Data (World Bank, 2021); https://data.worldbank.org/

Wang, Q. et al. Distributional impact of carbon pricing in Chinese provinces. Energy Econ. 81, 327–340 (2019).

Wood, R. et al. Prioritizing consumption-based carbon policy based on the evaluation of mitigation potential using input–output methods. J. Ind. Ecol. 22, 540–552 (2018).

Acknowledgements

We acknowledge funding from the National Natural Science Foundation of China (72243004, 72125010, 72243011, 71974186), the United Kingdom Research and Innovation (UKRI) Research England QR policy support fund (PSF-16) and the China Scholarship Council PhD programme (Y.G., J.Y. and B.L.).

Author information

Authors and Affiliations

Contributions

Y.G., J.Y., Y.S. and K.H. designed the research. Y.G. and J.Y. led the analysis. Y.G. developed the model and performed the research with contributions from Y.Z., Y.H. and B.B. Y.G. visualized the results with contributions from Y.H. Y.G. and J.Y. drafted the manuscript with efforts from Y.S. and K.H. Y.L. and K.F. provided the data sources (expenditure data and global multi-regional input–output tables). Y.S. and K.H. supervised and coordinated the overall research. All authors participated in the revising of the manuscript.

Corresponding authors

Ethics declarations

Competing interests

The authors declare no competing interests.

Peer review

Peer review information

Nature Energy thanks Kangyin Dong, Andrea Gatto, Anne Owen and the other, anonymous, reviewer(s) for their contribution to the peer review of this work.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary information

Supplementary Information

Supplementary Figs. 1 and 2 and Tables 1–3.

Supplementary Data 1

All data generated and analysed in this study.

Supplementary Code 1

Zip file containing code necessary to recreate the main results of the analysis.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Guan, Y., Yan, J., Shan, Y. et al. Burden of the global energy price crisis on households. Nat Energy 8, 304–316 (2023). https://doi.org/10.1038/s41560-023-01209-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1038/s41560-023-01209-8

This article is cited by

-

Balancing cleaner energy and geopolitical interests in the complex transition of the European electricity mix: from Fukushima to the Ukraine war

Discover Energy (2024)

-

Dynamic relationship between green bonds, energy prices, geopolitical risk, and disaggregated level CO2 emissions: evidence from the globe by novel WLMC approach

Air Quality, Atmosphere & Health (2024)

-

Soaring energy costs from Russia–Ukraine war could impoverish millions

Nature (2023)

-

EU climate action through an energy poverty lens

Scientific Reports (2023)

-

Self-reported energy use behaviour changed significantly during the cost-of-living crisis in winter 2022/23: insights from cross-sectional and longitudinal surveys in Great Britain

Scientific Reports (2023)