Recommended

The most recent G20 meeting ended without making any headway on critical global governance crises. Despite Indian Prime Minister Modi’s plea for members “not to allow current tensions to destroy agreements that might be reached on food and energy security, climate change and debt,” differences on the war in Ukraine upended any consensus they could reach. Repeated cycles of mutual recriminations with escalating rhetoric between the US and China have now led to stalled negotiations on debt and other areas of global governance. Brad Stetser captures the resulting crisis in a Twitter thread: Essentially, the IMF and the World Bank kept the net flow of funds to poorer countries during the pandemic, but the IMF has no more concessional money and the World Bank cannot stretch its balance sheet without an infusion of new capital. When the IMF recently raised its lending limits for emerging economies, it did not raise them for frontier economies. With other creditors essentially out of the game—lower Chinese lending and countries effectively shut out of bond markets—the failure to resolve the debt crisis is causing massive economic scarring.

For countries like Pakistan, Sri Lanka, Ghana, and Zambia that are stuck in limbo and waiting to resolve their debt crises, this is a continuing nightmare. The IMF, World Bank, Paris Club members, and India claim that China is frustrating debt relief talks, while Beijing argues that multilateral and commercial creditors hold significantly more debt and should therefore absorb most of the debt writedown. The G20 confab only hardened these positions as Chinese government officials repeated these talking points to both domestic and international audiences.

Issues of global governance have become subsumed in great power conflicts, but lost in this impasse are the lives of millions whose governments await a resolution. There is a clear need for a third thread in this narrative. Frustrated with a lack of movement through the G20’s Common Framework, at least two African countries, Ethiopia and Ghana, have engaged China directly. But this is hardly a permanent solution. Zambia’s direct approach still still resulted in default. And there is a reason for that.

In the leadup to Zambia’s default, its private creditors (mainly Eurobond holders) “sought greater clarity from the government over Zambia’s Chinese debt obligations, concerned that further debt financing will be used to pay off China before themselves.” The terms of Zambia’s engagement with China, however, meant the information Zambia provided commercial creditors fell below their threshold of transparency. These commercial creditors voted to deny Zambia’s request for deferral.

It is not evident that Ethiopia or Ghana will fare any better, since they too have private creditors and there is no indication that the standard of transparency will be met in their negotiations with China. The impasse is worsening economic difficulties in vulnerable economies, as countries find it difficult to pay for imports, provide basic public services, or service existing debt given high debt service costs. This stalemate is untenable. The African Union, which has been demanding a permanent G20 seat to influence global governance, has an opportunity to advance a third way outside the two existing camps and present a proposal which is able to a) acknowledge and account for China’s outsized and unique position among bilateral creditors and b) drive political consensus around an resolution based on the same principles as Multilateral Development Relief Initiative (MDRI), thereby preserving the preferred creditor status of the international finance institutions.

But first, how did we get here?

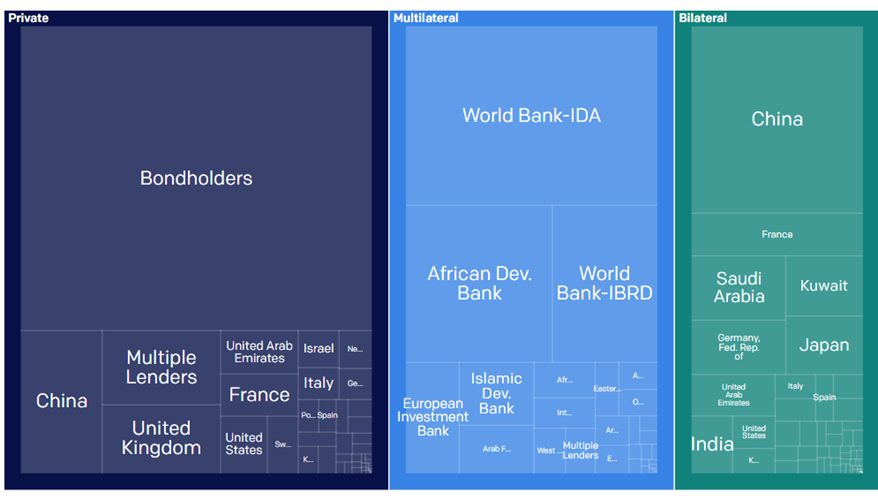

Over the last two decades the profile of sovereign debt has shifted dramatically. The relative weight of each group of creditors changed, with members of the Paris Club (a group of mostly high-income donor countries) losing ground to private creditors and China. This reconfiguration raises serious doubts about the suitability of the existing infrastructure to resolve sovereign default.

Rising populations and the expansion of rights across the developing world placed tremendous pressure on governments to provide basic services and infrastructure for their people. For emerging and frontier markets deemed too risky by other borrowers, China emerged as the creditor of choice. Many countries also gained access to international capital markets. As African governments gained access to these markets, commercial lending also increased. In the thirteen years between 2007 and 2020, twenty-one African countries issued Eurobonds, some for the first time. By 2021, the stock of Eurobonds from African countries reached $140 billion. The expanding complexity of the debt landscape, especially in the diversity of creditors, has hampered transparency around debt as both bilateral and commercial creditors have been able to push for a wider use of confidentiality clauses. Sustainable borrowing requires clarity, reliability, and timeliness of reporting on public finances.

This changing landscape diminished the power of traditional bilateral lenders, especially the Paris Club. The economic scarring of COVID-19 pushed 73 countries into debt distress, qualifying them for some measure of relief. In the first demonstration of the newly limited relevance of the Paris Club, the IMF and World Bank also reached out to the G20 to intervene—leading to the formation of the Debt Service Suspension Initiative (DSSI) in May 2020. According to the World Bank, “Forty-eight out of 73 eligible countries participated in the initiative before it expired at the end of December 2021.”

Breakdown of African debt by creditor today

(Source: https://data.one.org/topics/african-debt/)

DSSI did more than demonstrate China’s new status as premier bilateral creditor; it also revealed the enormous influence of commercial creditors. Many finance ministers in countries eligible for DSSI relief avoided seeking the process out of fear that credit rating agencies would interpret any such forbearance as a credit event, effectively shutting them out of capital markets. On DSSI’s sunset, its successor, the Common Framework, faced similar weaknesses: sparse and hesitant debtor uptake and a lack of agreement among creditors. In February 2021, as suspected by debtor countries, Fitch Ratings, one of the major credit rating agencies, confirmed that it believed “that a decision to seek debt restructuring under the Common Framework (CF) for Debt Treatments announced last November by the G20 and the Paris Club is unlikely to be compatible with a rating higher than ‘CCC’.” Ethiopia, which had sought restructuring under the Common Framework, was affected, with Fitch downgrading Ethiopia’s rating to ‘CCC’ from ‘B’/Negative.

Further shocks to the global economic system

As global institutions struggled to untangle these positions and deliver reprieve to the 73 countries that were suffering from the combination of already-high debt and the initial economic effects of COVID, the global landscape turned even more inhospitable. First, in response to the health and economic fallout of the pandemic, governments all over the world, but especially in developed economies, provided massive stimulus packages. According to this July 2022 Fed Notes, a back of the envelope calculation “suggest[ed] that U.S. fiscal stimulus during the pandemic contributed to an increase in inflation of about 2.5 percentage points (ppt) in the U.S and 0.5 ppt in the United Kingdom.” High inflation forced central banks in the US and other developed economies to raise interest rates. For many debt distressed countries that had issued debt in Eurobonds, their debt servicing costs rose, aggravating an already difficult situation. This situation deteriorated even further when Russia invaded Ukraine. The invasion and the punitive Western sanctions combined to roil the global economy, hiking food and fuel prices and punishing countries whose reserves had already been depleted by their response to COVID. Floods in Pakistan and Nigeria and drought in the horn of Africa only worsened already dire situations.

A third way

Development Reimagined, a consultancy that works on China-Africa issues, proposes a borrowers’ group as the counterpart to creditor groups like the Paris Club. Like its creditor interlocutor, the Lusaka Club (named for the Zambian capital) would be an informal convening of debtor countries to coordinate among borrowers and propose common positions on sustainable solutions in times of debt distress. This recommendation imagines the Lusaka Group as a project of the African Union, bolstering its case for G20 membership by proposing a solution that could actually work. To ensure autonomy and independent decision-making, both in practice and perception, it would be important that the Lusaka Club is completely financed by its members. The independence of a borrower group which is financed through “aid” from traditional donor partners would be threatened. Perhaps more damagingly, it would inevitably raise Chinese suspicions that it is just another underhand device for rivals to undermine it. The Lusaka Club would:

1. Agree and commit to a set of principles making it difficult for any individual member to be pressured into abandoning these collective positions and undermining its standing within the group. Those principles would also be a convenient response to pressure from powerful creditors. Indicative principles could include:

- Preserve the ability of multilateral development banks (MDBs) and their ability to borrow and lend cheaply. The World Bank’s Twin Goals of a) eliminating extreme poverty and b) advancing shared prosperity are only possible in a world where the Bank and other MDBs can borrow at a low cost, and pass those rates along to lower-income countries. Countries coming out of civil war or responding to pandemics and epidemics need a source of cheap financing as they get back on their feet. Preserving the MDBs’ ability to function has to be non-negotiable in any debt resolution framework.

- Remain open to reform only so far is it delivers an option that is superior to current arrangements. Some creditors have questioned the IMF framework and the use of the Debt Sustainability Analysis in determining how much haircut each creditor should take to achieve debt sustainability. Members of the proposed Lusaka Club should commit to using that framework unless a dissatisfied creditor presents a superior mechanism. It is not in borrowers’ interest to dismiss the existing framework without an viable alternative.

2. Ensure MDB participation: Create a benchmark (preferably overwhelmingly in IDA-eligible countries) along the lines of MDRI to allow for some debt forgiveness in exchange for public policy reform including, but not limited to, climate investment, public financial management, and human capital development.

The urgency of the moment and rising inflexibility among great powers create the need for a third way. The initiative for a borrowers' club, driven by the African Union but open to other affected countries from other regions, would inject a different narrative into the ongoing conversation dominated by China and Paris Club members and MDBs. It’s a good proposal—and it’s time for borrowing countries to make it happen.

Disclaimer

CGD blog posts reflect the views of the authors, drawing on prior research and experience in their areas of expertise. CGD is a nonpartisan, independent organization and does not take institutional positions.

Image credit for social media/web: Adobe Stock