|

|

|||||

This week, we highlight the key announcements made at the World Bank-IMF Spring meetings taking place in Washington DC. |

|||||

|

|

|||||

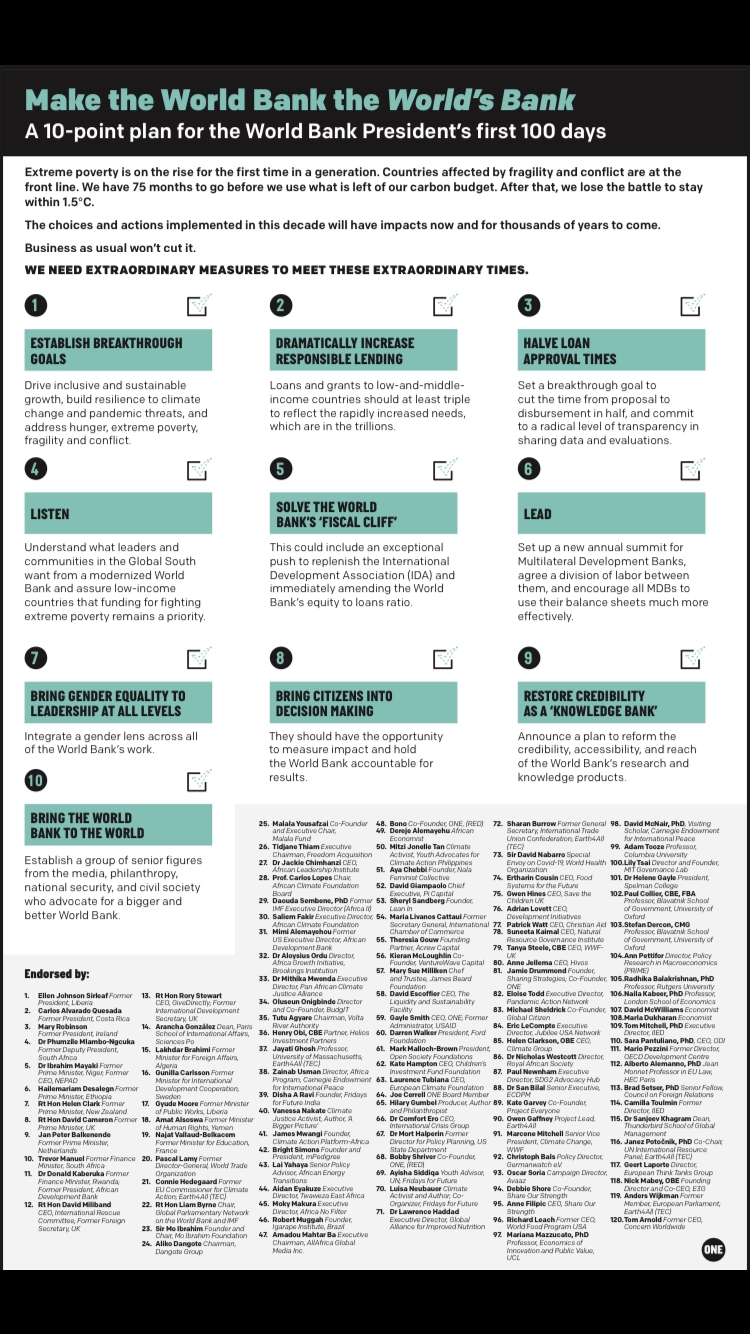

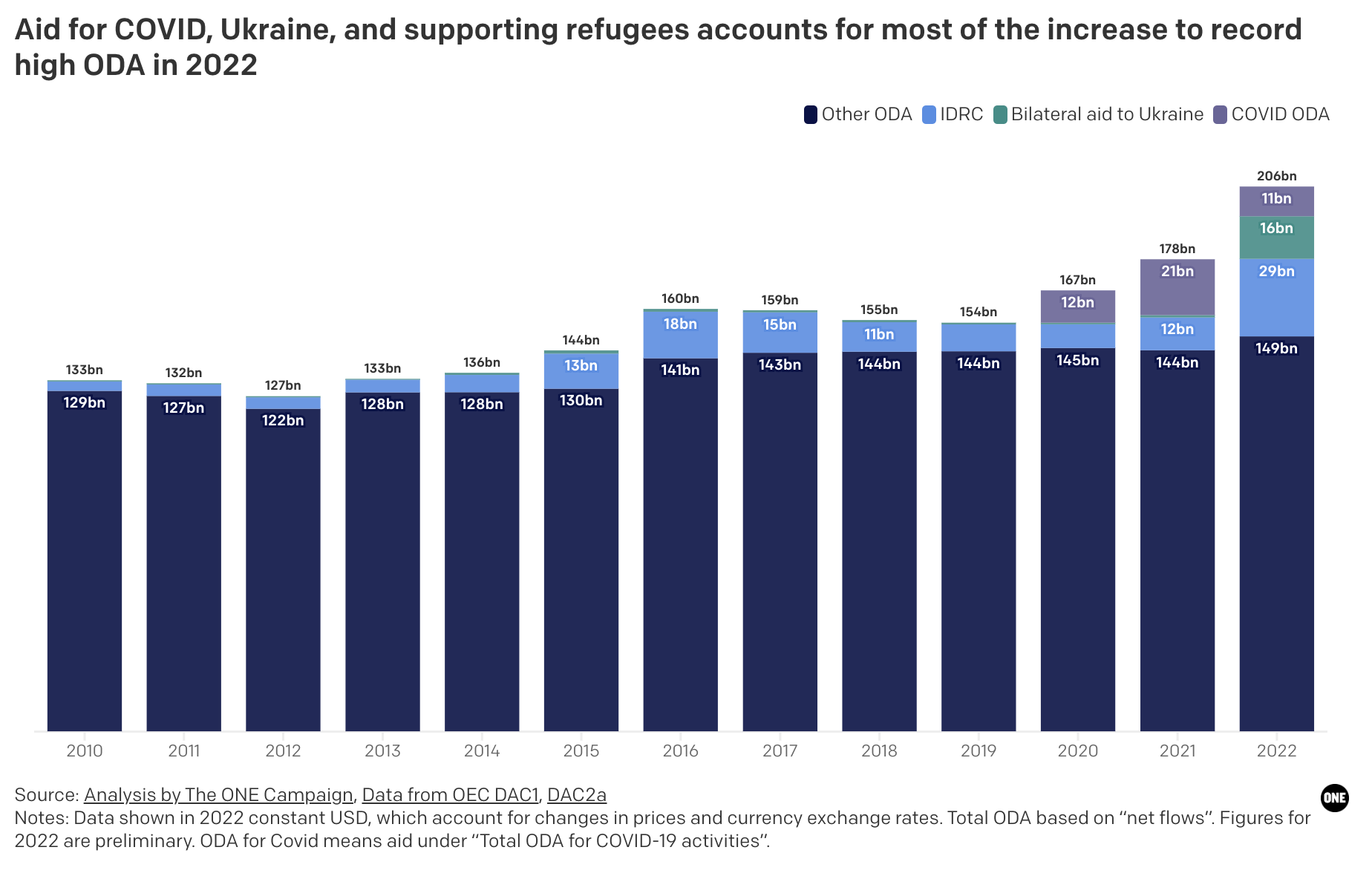

Top newsDebtors’ prison: China is reportedly dropping its demand that multilateral creditors share losses alongside other creditors, removing a major obstacle to debt relief for debt-distressed countries. In exchange, China received assurances that multilateral lenders would provide new concessional financing, including grants, to countries whose debt is being restructured. The news comes on the heels of a new UNDP report that shows the full cost of credit rating idiosyncrasies in Africa. The so-called “African Premium” is $74.5 billion in excess interest and foregone funding. That’s 12% more than all foreign aid to Africa in 2020. Seven African countries are spending more than 25% of government revenues to pay the interest on their debt. 👀 Meanwhile, experts are warning of a debt-driven “development crisis” that could set back future generations, as governments are forced to cut social services to finance debt repayments. Slow lane: The IMF is warning that persistent inflation coupled with higher interest rates significantly increases the chances that the global economy will make a “hard landing.” It says there is a 15% chance of a global recession and a 25% chance that growth will slow to levels hardly seen since 1970. The IMF currently expects 2.8% global economic growth this year and 3% in 2024. Global inflation is expected to fall from 8.7% in 2022 to 7% in 2023 and 4.9% in 2024, but is proving “stickier than anticipated,” so stay tuned. Own goals: Record levels of overseas aid is being spent within its country of origin, undermining efforts to fight extreme poverty, according to updated analysis from ONE. Overseas aid reached a record $204 billion in 2022, up 13.6% from the year before. Good news, right? Not quite: an unprecedented $29.3 billion, or 14.4% of that money, never left donor countries. 🤯 As a result, bilateral ODA to African countries declined last year by more than 7%. That comes at a time when many countries are facing challenges from climate threats, hunger shocks, debt distress, and the pandemic.  Redrawing rights: The G24 called for more votes and a third seat for sub-Saharan African countries at the IMF. It also called for a realignment of shares in favour of lower-income countries (stands and applauds). And it called for rich countries to deliver the $100 billion in Special Drawing Rights (SDRs) that they promised in 2021 and to channel them through multilateral development banks. Wealthy countries are $35 billion short of their pledge, though on Wednesday G7 finance ministers (once again) reiterated their support for SDR channelling (Actions. Speak. Louder). The French government plans to call on countries to rechannel at least 30% of their SDRs to vulnerable countries and will make it a priority of the summit it hosts in June. Meanwhile, a new study suggests that European Central Bank President Christine Lagarde may have been wrong about the EU being unable to unlock $200 billion in SDRs. Reform minded: Calls for meaningful reforms of the multilateral development banks are growing louder. This week, several African finance ministers called for commitments from the International Development Association and the International Bank for Reconstruction and Development to be tripled. The G24 called for the World Bank to increase lending through better leveraging its balance sheet. And 120 prominent figures called on the World Bank to implement a 10-point plan for reform. As expected, on Wednesday the World Bank’s Development Committee announced an additional $50 billion over 10 years through tweaks to the Bank’s balance sheet. That's 0.2% of the $2.4 trillion that low- and middle-income countries will need to spend each year by 2030 just to address climate change. The committee also agreed to make progress on several things: eliminating the Statutory Lending Limit, balance sheet optimisation for IDA, an IDA Crisis Facility, enhanced callable capital, and SDR channelling. Tick tock. ⏰ Funding trust: IMF Managing Director Kristalina Georgieva says that 44 countries are interested in support from the IMF’s Resilience and Sustainability Trust (RST), and that its capacity may need to increase to meet such high demand. She called on other countries to join France in boosting SDR pledges to 30%. The RST has received 25 billion in SDRs (against a target of 33 billion SDRs). Meanwhile, the IMF’s Poverty Reduction and Growth Trust (PRGT) is more than 3 billion SDRs below its funding target. A few countries are expected to make pledges this week: Saudi Arabia will commit 2 billion SDRs in loan resources to the PRGT, while Ireland will pledge PRGT subsidy grant resources. Switzerland will indicate its intent to pledge to the RST. 🎉 From the ONE Team

The numbers

|

|||||

|

|

|||||

Quote of the week

|

|||||

|

|

|||||

What you should read, watch, and listen to:

|

|||||

|

|

|||||

A look ahead15 - 16 April: G7 Ministers’ meeting on Climate, Energy, and Environment in Sapporo, Japan. 16 - 18 April: G7 Foreign Ministers’ meeting in Karuizawa, Japan. 17 - 20 April: UN ECOSOC Finance for Development Forum in New York City, US. 18-20 April: Global Fund Advocates Network Annual Meeting in Nairobi, Kenya. 19 - 21 April: UNESCO International Conference on Climate Risk, Vulnerability, and Resilience Building in Paris, France. |

|||||

|

|

|||||

The ONE Campaign’s data.one.org provides cutting edge data and analysis on the economic, political, and social changes impacting Africa. Check it out HERE. |

|||||

|

|

|||||

|

|

|||||

Did you like today's email?Loved it Mehhh Hated it |

|||||

|

|

|||||

Did you like today's email?Loved it Mehhh Hated it |

|||||

|

|

|||||

Wie hat dir dieser Newsletter gefallen?Richtig gut! Ging so… Überhaupt nicht. |

|||||

|

|

|||||

|

|||||

|

|||||

|

|||||

|

This email was sent by ONE.ORG to test@example.com. You can unsubscribe at any time. ONE Campaign |